Table of Content

The extra draw back safety the policyholder elects, the much less potential upside they may obtain. Typically, structured annuities will offer two methods of limiting draw back publicity. SIMON Markets LLC operates a know-how platform that makes out there choices of structured investments and annuities to monetary professionals. In working this know-how platform, SIMON Markets LLC earns revenue based on the volume of transactions that happen in these products and would profit by a rise in gross sales for these merchandise. A structured annuity is a long-term, tax-deferred monetary car used primarily for retirement. Its design gives investors the opportunity to earn curiosity based available on the market growth of an index or indices that they choose.

Transfers into new portfolio choices take place on the 10th of every month. To generate growth potential while seeking focused downside protection, think about our Advanced Outcomes Annuity®. By 1985, the National Structured Settlements Trade Association shaped to protect and promote structured settlements to injury claimants by way of schooling and advocacy. Business and finance journalist Juliette Fairley defines a structured settlement annuity. CBC and Annuity.org share a typical goal of educating customers and helping them make the greatest possible choice with their money.

Superbubble’s Final Act? Or Is That This Time Different?

Selling your annuity or structured settlement funds could be the answer for you. For these “chicken equity investors” who need some upside market participation and some downside safety in a tax-deferred wrapper, you might think about exploring structured annuities. If the aim of the annuity is to provide both present or future earnings, then you would doubtless recommend either an instantaneous annuity , deferred income annuity , or an annuity with a dwelling benefit rider.

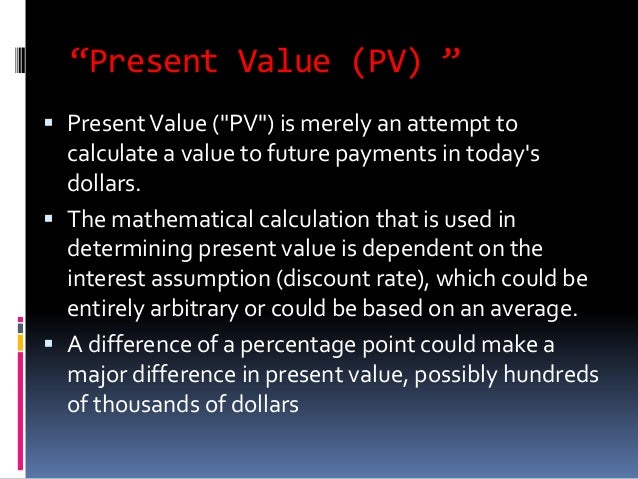

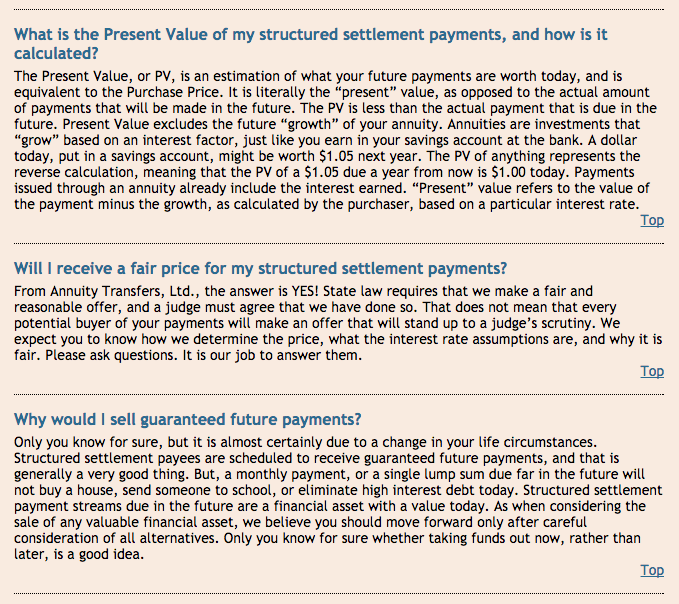

It’s sensible to speak with a financial advisor or an attorney to discover your choices before promoting. Because structured settlements are supposed to earmark cash for an injured party’s future, strict state and federal legal guidelines govern the sale of funds to 3rd events often recognized as factoring companies. A structured settlement disperses money from a lawsuit steadily over time to behave as a safety web and provide long-term financial safety to the injured celebration. While a structured settlement is a stream of payments, the proprietor does not need to pay income taxes on the cash acquired. The Periodic Payment Settlement Act of 1982 helped solidify this exemption for injured events and their beneficiaries. A structured settlement annuity contract typically yields, in whole, greater than a lump-sum payout would because of the interest the annuity might earn over time.

Running Out Of Cash In Retirement: What’s The Risk?

Structured settlement annuities and/or periodic fee reinsurance are only out there via licensed agents appointed with structured settlement authority by the underwriting life insurance company. The Allianz Index Advantage variable annuity allows owners to spend money on three index-linking choices (S&P 500, Nasdaq-100 and Russell 2000) in addition to three variable options . The “index performance” strategy features a buffer, which is set at coverage concern, that absorbs the first 10 % of a adverse index return in any given 12 months. The minimal cap on performance for in-force contracts is 1.5 p.c however the cap may be larger and many change yearly.

Finally, there's a commutation rider on some settlements that permit the inherited annuity to be paid out in a lump-sum fee, so examine on that as well. An alternative to a lump sum payout, structured settlements are periodic funds made to a plaintiff who wins or settles a personal harm lawsuit. Instead of receiving a lump sum of cash for damages, a collection of scheduled payments are made from the defendant to the plaintiff over time. The result of receiving a structured settlement is increased financial security for the plaintiff and assistance to pay for medical bills or other necessities. An assigned case is a certified case, that means the settlement proceeds qualify for tax benefits, and the defendant’s cost obligation must align with Internal Revenue Code provisions.

Structured settlements are periodic payments awarded to an injured party following sure court docket cases. Payments are most often funded by way of an annuity contract with a life insurance coverage firm. But annuities can serve different purposes, too, such as revenue security in retirement. The life insurance coverage company pays the plaintiff a collection of payments over time, in accordance with the terms of the annuity contract. The annuity earns curiosity to protect its worth from inflation, and the one way for the plaintiff to get money from the settlement ahead of schedule is to promote the right to future payments on the secondary market. Cash flows can be diversified by cut up funding between more than one life insurance coverage company and/or between mounted, index-linked structured settlement annuities and market based structured settlement solutions.

Many civil lawsuits result in somebody or some firm paying money to another to right a mistaken. Those liable for the mistaken could conform to the settlement on their own, or they might be forced to pay the money once they lose the case in court docket. Our imaginative and prescient is to offer customers with the highest high quality data attainable about their monetary options and empower them to make informed selections primarily based on their unique needs. You agree to our privateness policy and disclaimer by submitting your contact data. After submitting, you'll be contacted by a number of of Annuity.org’s trusted partners (including autodialed and prerecorded calls or text/SMS messages). Your consent to text messaging is not required for a session and you could opt-out of text messages at any time by texting STOP.

Is An Annuity An Excellent Investment?

You promote your settlement funds at a heavy discount through a settlement transfer in exchange for a lump sum of cash. This transfer is called a Structural Settlement Factoring Transaction. A structured variable annuity – additionally sometimes known as a variable listed annuity, a buffer annuity or a structured annuity – is basically a mix of a variable annuity and a hard and fast listed annuity . Depending on the insurance company selling it, it may supply more market upside than an FIA. In a down market, it doesn’t offer as much protection as an FIA however does provide some – markedly extra, in fact, than the zero-protection offered by a variable annuity.

The Product referred to herein isn't sponsored, endorsed, or promoted by MSCI, and MSCI bears no legal responsibility with respect to any such Product or any index on which such Product is predicated. The prospectus incorporates a extra detailed description of the limited relationship MSCI has with Equitable Financial Life Insurance Companyand any related products. If you're interested in selling your annuity or structured settlement payments, a representative will offer you a free, no-obligation quote. We companion with CBC Settlement Funding, a market chief with over 15 years of experience in the settlement buying area. Our relationship with CBC allows us to facilitate the acquisition of annuities and structured settlements from shoppers who are trying to get a lump sum of money instantly for his or her stream of month-to-month funds.

The annuity is an irrevocable stream of standard funds from an insurance coverage firm, which is dictated by the courtroom system. You may immediately receive a structured settlement annuity as part of the court docket decision. In this case, you can sell it to a settlement firm, a monetary or insurance coverage firm that makes a speciality of managing these kind of investments, if you need a lump sum. On the other hand, when you obtain a lump sum, you can use it to purchase a structured settlement annuity. It could additionally be a useful way to budget the money, and it represents a wise decision for anybody who has trouble managing giant sums of money, particularly if they're financially dependent on their settlement.

The Product referred to herein is not sponsored, endorsed, or promoted by MSCI. Gold SPDR Shares — Seek to reflect the performance of the price of gold bullion. The investment efficiency of the SPDR®Gold Shares Segment is only based mostly on the closing share value of the Shares. The SPDR®Gold Shares Segment doesn't embrace dividends and other distributions declared by the Shares. Advanced Outcomes Annuity offers structured outcome methods with underlying funds which have traits in distinction to many other traditional funding merchandise and is in all probability not appropriate for all traders.

If the sum of money is small enough, the wronged celebration could have the option to receive a lump sum settlement. For larger sums, however, a structured settlement annuity may be organized. The industry does have capability left to write down more residing advantages enterprise, he stated, citing findings of a Cerulli study on the life and annuity industry he led this 12 months. As a outcome, carriers are taking a look at other annuity designs to grow future gross sales — annuities without living profit ensures however with features that “resonate” with advisors and customers and with flexibility, too. Joseph Halpern is Portfolio Manager of a defined consequence strategy at Catalyst Funds. Mr. Halpern has structured, priced, and traded billions of dollars in structured merchandise, unique derivatives, and listed vanilla choices.

No comments:

Post a Comment